QUANTIFIABLE SAVINGS

For investors, owners and developers of commercial buildings or residential rental property in the design phase, early-stage construction or renovation, Green Zip technology may reduce near-term tax liability and increase cash flow.

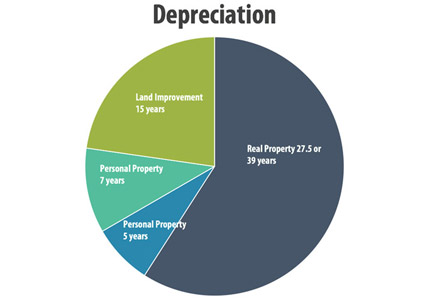

Commercial buildings and residential rental property have a depreciable life of 39 years and 27.5 years, respectively. Nonstructural elements include demountable drywall partitions, carpeting, wall coverings, and specialized mechanical, plumbing and electrical components with either a five-year or seven-year recovery period. The installation of demountable drywall partitions with Green Zip technology will accelerate depreciation by as many as 34 years. The result may be a near-term reduction in tax liability and meaningful increase in cash flow for the investor/owner of the property.

As an example, a tax paying investor in a $48 Million residential rental building was able to depreciate $11.1 million of expenses over five years as opposed to 27.5 years real property. On an after-tax basis, the additional depreciation expense amounted to $3.3 million over 5 years. In other words, the investor reduced its near-term tax liability and increased his cash flow by $3.3 million over the five-year period.

This example highlights the benefit of properly classifying assets in accordance with IRS guidelines.

There is an additional financial benefit to installing Green Zip drywall partitions. When the building is sold, the new owner will be able to claim the total amount of the accelerated depreciation identified in the cost segregation study, including the demountable drywall partitions recalculated on the basis of the property’s purchase price. This may provide the seller with a competitive advantage during the sales process.